Is CMS Biased in Favor of Medicare Advantage?

While studying Medicare & You 2021: The official U.S. government Medicare handbook to look for changes coming in the new year (which you can download here), the MedicareWire staff began noticing language and diagrams that it felt would bias readers. In fact, once you start looking for it, you can see that the handbook is littered with language that favors Medicare Advantage plans over traditional Medicare coverage, sometimes referred to as Original Medicare. This didn’t sit well with us, so we’re publishing this report to point out the bias.

[mapd_affiliate]

Is There a Reason for Bias?

So what’s really going on? Why would the Centers for Medicare and Medicaid Services have a bias in favor of private health plans?

The only logical reason for CMS’ bias is that Medicare Advantage saves the government money. And, in fact, the Medicare Payment Advisory Commission (MedPAC), a congressional agency established in 1997, states that:

The Commission contends that the growth in spending for the Medicare program poses a significant challenge for the federal government.

The Commission report goes on to say:

While these programs [Medicare Advantage] may be capable of reducing spending relative to the FFS [Part A and B fee-for-service] program, whether they produce substantial savings depends heavily on how they are structured.

A complete read of the Commission’s 2020 report shows that considerable effort is being put into restructuring Medicare Advantage to bring further savings to the government. The number one way to achieve more savings is to get more Medicare beneficiaries into the private insurance program and out of the fee-for-service coverage originally set up by the government.

MedicareWire is not claiming that there is anything nefarious going on inside CMS. We’re saying that the government’s efforts to save taxpayer money through the Medicare Advantage program have created a distinct bias in the beneficiary information that CMS publishes (i.e., Medicare & You).

For this very reason, what the government is not telling Medicare beneficiaries about traditional Medicare coverage versus Medicare Advantage needs to be said. How else can beneficiaries make one of the most important decisions of their life?

[mapd_search]

RELATED: Disadvantages of Medicare Advantage Plans

Medicare & You: Medicare Advantage vs. Original Medicare

The MedicareWire staff recently reviewed CMS’ new guide, which it describes as “the official U.S. government Medicare handbook,” with the intent to determine if the information presented is balanced. In this case, balanced simply means that the handbook equally describes the benefits and detriments of both types of Medicare health coverage.

MedicareWire believes this is important because the public should be able to trust that any official U.S. government document is neutral and unbiased. Any bias in favor of one option over another will undermine the trust beneficiaries have in the government’s information.

What follows are MedicareWire’s concerns with Medicare & You 2021: The official U.S. government Medicare handbook and how CMS treats coverage options in a way that is not neutral.

At 124 Pages and Growing, Do Charts Help?

The Medicare & You handbook packs a whopping 124 pages of information. It is a challenging read for anyone, particularly with so much health and insurance jargon.

Realizing that most people will not read the entire manual cover-to-cover, CMS has inserted summary information at the beginning of the book that might be helpful to readers. This is where MedicareWire feels CMS completely fails its beneficiaries with unbalanced language.

In the 2021 edition of the handbook, the summary information is on pages 6-8. Our objection is that most people will rely on these summary charts for their complete understanding of options. This is why it is essential that this at-a-glance information be accurate and, to the fullest extent possible, balanced.

Tipping the Scales

On page 8 of the handbook, CMS shows a symbol key with three helpful icons. One of these icons is a scale that is supposed to help the reader with comparisons between Original Medicare and Medicare Advantage. MedicareWire found seven uses of the scale icon throughout the book. In several cases, MedicareWire feels the authors oversimplified the topic in favor of Medicare Advantage plans.

In this example, CMS suggests that Medicare Advantage is a better option because the plans feature an out-of-pocket limit:

What’s missing is a reference to how Medicare supplements fill the gaps in Original Medicare, with the top plans all eliminating the need for an out-of-pocket limit.

What’s missing is a reference to how Medicare supplements fill the gaps in Original Medicare, with the top plans all eliminating the need for an out-of-pocket limit.

On this scale, CMS lets the reader know that MA plan members have the right to appeal a plan’s determination to deny providing a service, drug, or supply:

MedicareWire feels this is actually a backdoor attempt to put a positive spin on prior authorization approvals that MA patients are required to obtain before obtaining specialist services. We did not find a similar scale highlighting a beneficiary’s right to appeal Medicare’s denial of services, drugs, or supplies under Part A or Part B coverage.

We found that other scales simply over-promised high-demand services that Original Medicare does not cover, as highlighted on this scale:

MedicareWire analyzed all 2021 Medicare Advantage Special Needs Plans and found that fewer than 5 percent of plans available offer long-term care or adult day-care services.

What’s new?

The “What’s new?” section of the handbook offers helpful information about new benefits available to beneficiaries. However, in two paragraphs it references “plans” as a way to get coverage, but not Parts A and B. The lack of any reference to Part A and B coverage is most egregious under the heading “Get help with your Medicare coverage choices,” where CMS directs beneficiaries to go to Medicare.gov/plan-compare to shop for plans. The plan compare tool does not help beneficiaries compare Part A and B benefits with Medicare Advantage plan benefits.

Getting started

The “Getting started” section, which begins on page 4, explains that if you already have Medicare you should review your health and drug coverage every year in order to lower your out-of-pocket costs. Because beneficiary out-of-pocket costs with Part A and B always remains the same, the inference here is that you can get lower costs in a different plan.

Also on page 4, CMS highlights that you need to “Mark your calendar with these important dates!” The dates are the start and end of the Annual Election Period (AEP) for Medicare Advantage and Medicare Part D plans. There is no mention that the dates do not include Medicare Part A and B coverage, only that you can save money and get extra benefits when you shop Medicare.gov/plan-compare.

Your Medicare options

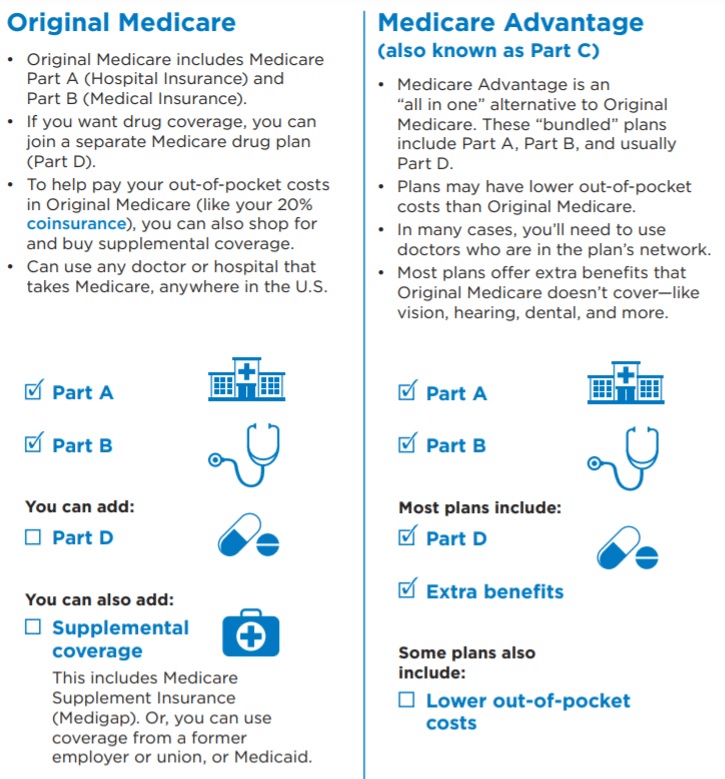

The “Your Medicare options” section of the handbook uses highly biased language and charts, as shown by this screen capture of page 6:

Here, CMS describes Medicare Advantage (MA) as having all of the coverage of Part A and Part B, and additional benefits, like Part D, vision, dental, hearing, and more. It also states that “Plans may have lower out-of-pocket costs than Original Medicare, contrary to a recent study by the Kaiser Family Foundation.

CMS also plays down a major objection to MA plans by most people who use Medicare Part A and B, healthcare provider networks. Here, CMS states, “In many cases, you’ll need to use doctors who are in the plan’s network,” which is a gross understatement. According to MedPAC, in 2020, nearly 23 million of the 24 million Medicare Advantage plan enrollees are in a coordinated care plan (aka, a health maintenance organization plan) that requires members to use network providers.

On the same page, CMS shows that beneficiaries can add Part D and supplemental coverage with the inference that doing so will incur more cost. At the same time, it does not state that many supplemental benefits offered in Medicare Advantage plans come with a supplemental monthly premium.

In general, the presentation of information on this page is unbalanced because:

- It does not explain that supplementary benefits in Medicare Advantage plans are capped;

- It does not explain that supplementary benefits in Medicare Advantage plans may have an additional monthly premium;

- It downplays healthcare provider networks in HMO plans;

- It suggests that out-of-pocket costs will be lower with an MA plan;

- It insinuates that MA plans are better because they are an “all in one” solution.

- It does not in any way contrast the flexibility of coverage options, healthcare providers, and portability of Part A and B coverage with Medicare Advantage.

The most significant problem with page 6 of the Medicare & You handbook is that Medicare is complicated and it tried to simplify a beneficiary’s understanding of the options into a single chart. In so doing, MedicareWire is concerned that many beneficiaries will not read further to get more details.

Signing up for Medicare

The bias for Medicare “plans” vs. “parts” continues on page 16 under the heading “Who has to sign up for Part A/and or Part B”. At the bottom of this page, CMS highlights the final paragraph, which says:

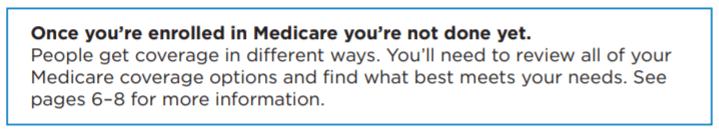

The statement “…you’re not done yet” suggests that if you are enrolled in Part A and Part B for coverage there is still something else left that you must enroll in. This is factually true for people who need Part D coverage for their prescriptions, but the statement is ambiguous and is not inclusive of people with other types of coverage, including Medicaid, retiree health benefits, VA, etc. Plus, it redirects readers right back to page 6 (above).

The statement “…you’re not done yet” suggests that if you are enrolled in Part A and Part B for coverage there is still something else left that you must enroll in. This is factually true for people who need Part D coverage for their prescriptions, but the statement is ambiguous and is not inclusive of people with other types of coverage, including Medicaid, retiree health benefits, VA, etc. Plus, it redirects readers right back to page 6 (above).

Getting Lower Costs

In several locations in the handbook, CMS suggests that Medicare Advantage plans “may lower costs,” but there are no warnings that plans may actually increase costs. In its own research, MedicareWire finds that the copay structure of a large percentage of Medicare private health plans is more expensive or no less expensive than the 20 percent coinsurance structure in Original Medicare.

MedicareWire feels that the CMS language regarding MA plans and their potential cost savings is misleading and does not accurately represent real-world experience by many MA plan enrollees. Our assessment is backed up by recent Kaiser Family Foundation information that claims, “Half of all Medicare Advantage enrollees would incur higher costs than beneficiaries in traditional Medicare for a 5-day hospital stay.”

[mapd_affiliate]

Summary

MedicareWire is deeply concerned that the official U.S. government Medicare handbook does not present balanced information to its beneficiaries. Taxpayers contribute to the Medicare system throughout their working years. As such, they have a vested interest in both the program and the benefits they receive. Without access to accurate, balanced information from the program itself, many beneficiaries will not be able to make sound, informed decisions.

[mapd_search]