How to Choose a Medicare Advantage Plan in 7 Steps

Medicare Advantage is a Medicare-approved alternative to Original Medicare for your health and drug coverage. These “all-in-one” plans include Part A, Part B, and usually Part D. Medicare allows private health insurance companies to offer various plan types, so long as they cover everything covered by Medicare Part A and Part B.

What are 4 Types of Medicare Advantage Plans?

HMO, HMO-POS, PPO, and PFFS plans are the 4 most common Medicare Advantage plans, but there are more, including Medicare Savings Accounts. The type of plan you choose is the most critical decision you need to make

This article will go over all of the different plan types offered under Medicare Part C (Medicare Advantage), help you better understand which plan type is best for you, and offer a 7-step method to compare plans.

[keytakeaways]

- Medicare Advantage plans are offered by private insurance companies.

- Plans must cover all Medicare-approved Part A and Part B (Original Medicare) services.

- Plans are allowed to include services not covered by Original Medicare.

- Plans set their own out-of-pocket costs (deductibles, copays, and coinsurance).

- Plans set their own rules, including provider networks, referrals, and prior approvals.

- Plans can change benefits, providers, and costs annually.

[/keytakeaways]

Why Compare Plans?

Most Medicare Advantage plans use provider networks and access controls to save money. Unlike the government, insurance companies are in business to make money. Provider networks and access controls are the primary tools plans have to control their costs.

It’s important to take this into account before you choose a plan. In other words, can you work within the limitations a plan puts in plans?

Here are the primary reasons you should compare Medicare Advantage plans:

- Protect yourself from high medical bills.

- Get access to your preferred healthcare providers.

- Get additional money-saving benefits.

Types of Medicare Advantage Plans

Most Medicare Advantage plans have provider networks and network access restrictions. This is an important feature that needs careful consideration.

Health Maintenance Organization (HMO) Plans

HMO plans deliver healthcare through a network of doctors, hospitals, and other medical professionals that you must use or to be covered for your care. HMOs generally have the lowest monthly premiums, but out-of-pocket costs may be higher than Original Medicare.

Preferred Provider Organization (PPO) Plans

PPO plans, like HMOs, have provider networks. You pay less if you use doctors, hospitals, and other healthcare providers that belong to the plan’s network. However, with a PPO plan, you are not strictly restricted to using providers in the network

HMO Point-of-Service (HMO-POS) Plans

With an HMO-POS, you have the option to go outside of the plan’s network for care, but you’ll pay more when you do. Plus, the HMO and POS portions of the plan have separate deductibles. Care you receive in-network through the HMO has a different deductible than the care you get out-of-network through the POS.

Private Fee-for-Service (PFFS) Plans

A PFFS plan sounds a lot like Original Medicare and Medigap, but it’s not. The plan determines how much it will pay doctors, other health care providers, and hospitals, and how much you must pay when you get care. You can go to any Medicare-approved doctor or hospital that accepts the plan’s payment terms and agrees to treat you.

Medicare Savings Account (MSA) Plans

An MSA plan combines a high-deductible insurance plan with a medical savings account that you can use to pay for your health care costs. The medical savings account is funded in January each year.

Medicare-Medicaid Plans (MMP)

MMPs provide coordinated Medicare and Medicaid benefits for dually eligible individuals. They simplify the processes for dual-eligible people so they can gain access to the care they are entitled to under both programs. This includes providing beneficiaries with seamless enrollment and access to high-quality healthcare.

Medicare Cost Plans

Medicare Cost Plans are a type of Medicare health plan available in certain, limited areas of the country. Unlike other plans, you can join even if you only have Part B. If you have Part A and Part B and go to a non-network provider, Original Medicare covers the services. You’ll pay the Part A and Part B coinsurance and deductible. Also, you can get your Medicare drug coverage from either the plan or you can join a Medicare Part D plan.

Special Needs Plans (SNP)

SNPs are not a different type of plan, per se. They are most commonly HMO and PPO plans, but enrollment is limited to people with special health, financial, or institutional needs. For this reason, we are listing them as a different plan type. Where available, they are an important resource for qualified individuals.

How to Compare Plans

Now that you know the various types of plans available, it’s time to understand how to compare plans so you can find the best plan for you. Here are the most important features to compare:

- Coverage. It’s important to look at what a plan pays vs. what you pay out-of-pocket for your major medical costs. This is your coverage. If you are a healthy person, you may be able to get away with less coverage. If not, you probably need more coverage.

- Benefits. All plans cover the benefits included in Original Medicare. Most plans also include prescription benefits. Some plans include routine dental, vision, hearing, transportation, gym, and other valuable benefits. These benefits can save you money.

- Providers. As previously mentioned, most plans use provider networks. If you need care from a specific provider, you’ll need to ask them which plans they accept.

- Quality. Medicare rates plans on their performance. These 5-star performance ratings offer a glimpse at the quality of care you can expect when you join a plan.

All four of these points are important. However, the most important is coverage. Let’s face it, additional benefits won’t mean much to you if you can’t afford your primary care.

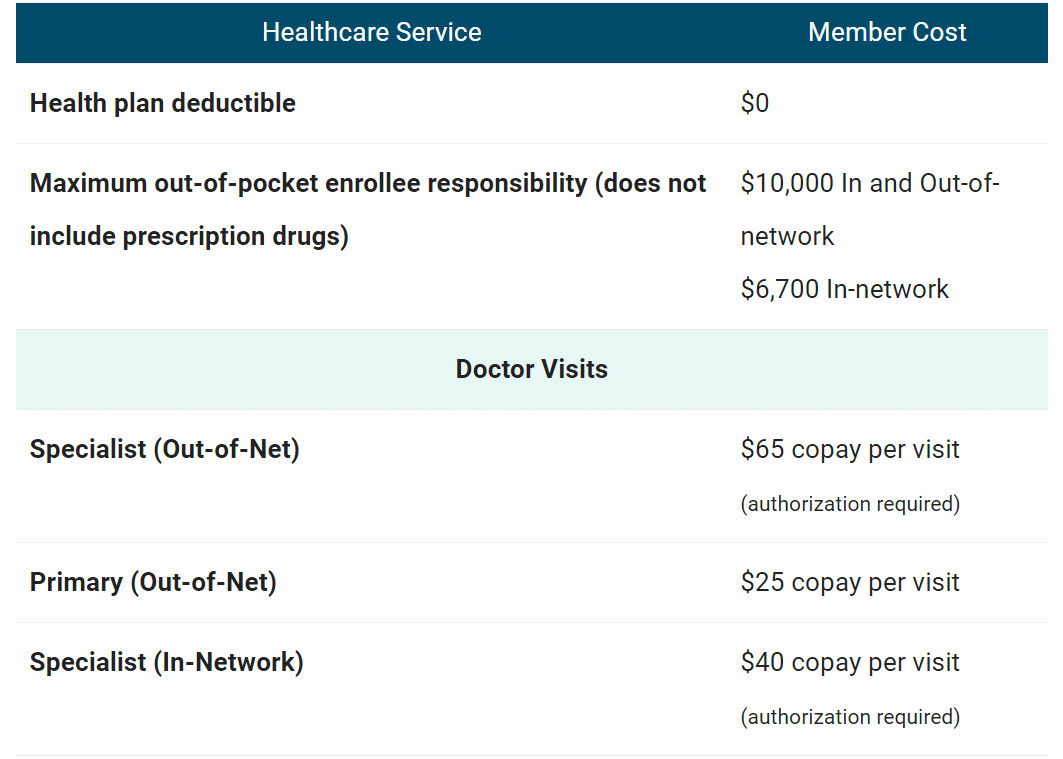

For this reason, MedicareWire publishes what you will pay out-of-pocket for each type of primary care service (e.g., emergency room, hospitalization, doctor office visits, specialists, etc.). You will find this information on each plan page when you compare Medicare Advantage plans in your area.

It looks like this:

We do the same for Special Needs Plans. However, because SNPs are so specialized, we organize them in their own directory. You can compare Special Needs Plans in your area here.

In addition to what you’ll pay for specific services, be sure to also take into account a health plan’s deductible and maximum out-of-pocket (MOOP) limits. These costs can be significant.

A plan’s MOOP, in particular, can make a significant difference in how much you will pay in a calendar year. For instance, a plan with a $1,500 MOOP and $40 copays to see your primary care doctor could be a much better deal than a plan with a $6,700 MOOP and $0 primary care copays.

It all depends on your use of healthcare services. You have to do the math. A zero-dollar could end up being the most expensive plan of all if it has high copays, a high MOOP, and you need frequent care.

The Value of Extra Benefits

The advantage of Medicare Advantage plans is that they can limit out-of-pocket costs and include additional benefits. Original Medicare does not have an out-of-pocket limit and only covers major medical services.

Extra benefits, such as a prescription drug plan and routine dental care, are very enticing. But, it’s important to evaluate the true value of extra benefits vs. the potential restrictions and costs a plan places on its primary care.

For example, is it worth having routine dental care benefits if you don’t have access to your preferred specialist or primary care doctor? Or, is it worth not having to pay for a separate Medicare Part D prescription drug plan if the plan does not cover your most expensive prescriptions at an affordable price?

It’s important to walk through the cost-benefit scenarios of a plan before making a decision. Your primary care is most important. It needs to come at a cost you can afford ahead of the extra benefits.

If you are a healthy individual and rarely need healthcare services outside of your preventive care, a plan loaded with extra benefits can be of great value.

Quality of Care

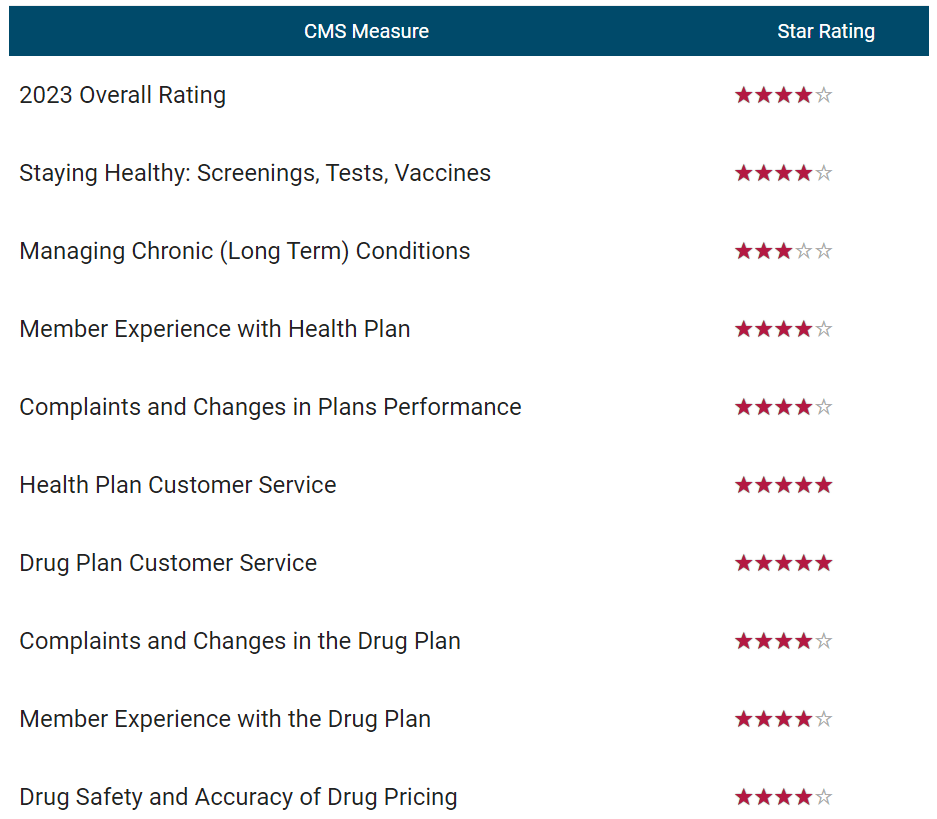

In the same way that we publish a table of out-of-pocket costs for each plan, MedicareWire also shows you a table of 5-star measures. It looks like this:

It’s important to look beyond a plan’s summary score. Medicare rates all health plans on 5 core measures and all drug plans on 4 core measures. These core measures are rolled up to come up with a summary score.

This is important because a plan may have an overall rating of 4.0 but scores one star in its management of chronic health conditions or customer service. If you have chronic health conditions, do you want a plan that fails in these areas?

A Step-by-Step Way to Compare Plans

When assisting visitors with their plan options, we use a 7-step method to help identify the top choices.

1. Start with a List of Plans in Your Area

Medicare Advantage plans are regional, not nationwide. Plans may have the same name in different areas, but provider networks change and costs change by county.

To see the plans available near you, use our Medicare Plan Finder.

[mapd_search]

2. Determine if You Qualify for a Special Needs Plan

Most people qualify for a Special Needs Plan due to their income. If you qualify for both Medicare and Medicaid, you will qualify for an SNP (if plans are available in your area). These are known as D-SNP plans.

[snp_search]

You may also qualify for an SNP due to a chronic health condition (C-SNP) or because you are institutionalized (I-SNP). Each of these types of plans will be listed on our Plan Finder pages.

3. Choose Your Preferred Network Type

A key disadvantage of Medicare Advantage plans is network restrictions. The type of network you choose (PPO, HMO, HMO-POS, PFFS) will directly impact your costs and your access to healthcare professionals.

For instance, HMOs generally have lower monthly premiums, but your coverage will have a limited number of doctors and healthcare facilities. Conversely, PPOs may have higher monthly premiums, but they offer expanded provider networks.

4. Compare Monthly Costs

If you join a Medicare Advantage plan you will continue to pay your monthly Medicare Part B premium, IRMAA surcharge (if any), and Medicare Part A premium (if you didn’t qualify for premium-free Part A). You will also pay any additional premium added by the plan.

Many plans have a zero-dollar monthly premium. This simply means that the plan is not adding any additional monthly cost over what you pay for your Part A and Part B coverage.

Generally speaking, plans with an additional monthly premium offer more extra benefits. Your goal should be to find a plan that offers the benefits you need most at an affordable monthly cost.

5. Compare the Cost of Your Prescriptions

Most Medicare Advantage plans include a Part D prescription drug plan. If you have regular prescriptions, this can complicate comparing plans.

Even though a plan included Part D benefits, the prescription drug plan has its own deductibles and copays. For this reason, it’s critical that you understand what you’ll pay for your medications. You can do this using the Medicare.gov Part D comparison tool.

All you have to do is enter your zip code, select “Part D only,” and follow the prompts to enter your medications and preferred pharmacy.

6. Consider Your Out-of-Pocket Costs

All Medicare Advantage plans have out-of-pocket costs. Even dual-eligible Special Needs Plans have some costs you must pay out-of-pocket.

It’s important to carefully evaluate your use of healthcare services with the deductibles, copays, and coinsurance a plan charges you when you use services. Each plan page provides this information. You can even download this information as a PDF file that you can print.

7. Consider Additional Benefits

Most Medicare Advantage plans include extra benefits. The most common additional benefit is a Part D plan for coverage of prescriptions. Other common extras include dental, vision, and hearing benefits. You will see all of these four common benefits listed on our plan pages.

If you need more specialized benefits, we recommend calling to speak directly with an advisor at 855-728-0510.

Conclusion

Medicare Advantage plans offer the right beneficiaries a great opportunity to save money and get more benefits. Whether or not a Medicare Advantage plan is right for you all depends on your individual healthcare needs and the plans available in your area.

To discuss your unique needs with a licensed Medicare Advantage agent, call 855-728-0510.